PAXXIT

The end of US leadership has consequences beyond the costs of tariffs

Elgie holiday snap

Epcot, Rockets, and the Return of the Trump Put

A badly timed family holiday to Florida this past week left me watching markets through a Chinese assembled iPhone, mainly in queues for rides at Disney. Being flung around at high speed in the dark probably sounds a lot like what most traders were experiencing last week.

My kids met an America that sits in strong contrast to the one they watch from home. At the Kennedy space centre, they saw images of bravery and common purpose. At Epcot, they saw optimism about the future and a carefully choreographed illusion of global harmony. Seeing America at its greatest, they could finally understand the desire for a MAGA message. Out there in markets, efforts seemingly to make America a manufacturing powerhouse again were going down badly. Perhaps it wasn’t optimal to deliver tariffs that looked like they were calculated by the intern and announced in the style of a playground bully. At NASA, listening to the words of some great American leaders, the contrast couldn’t have been starker. Some Americans need to be reminded that they were “not descended from fearful men”.

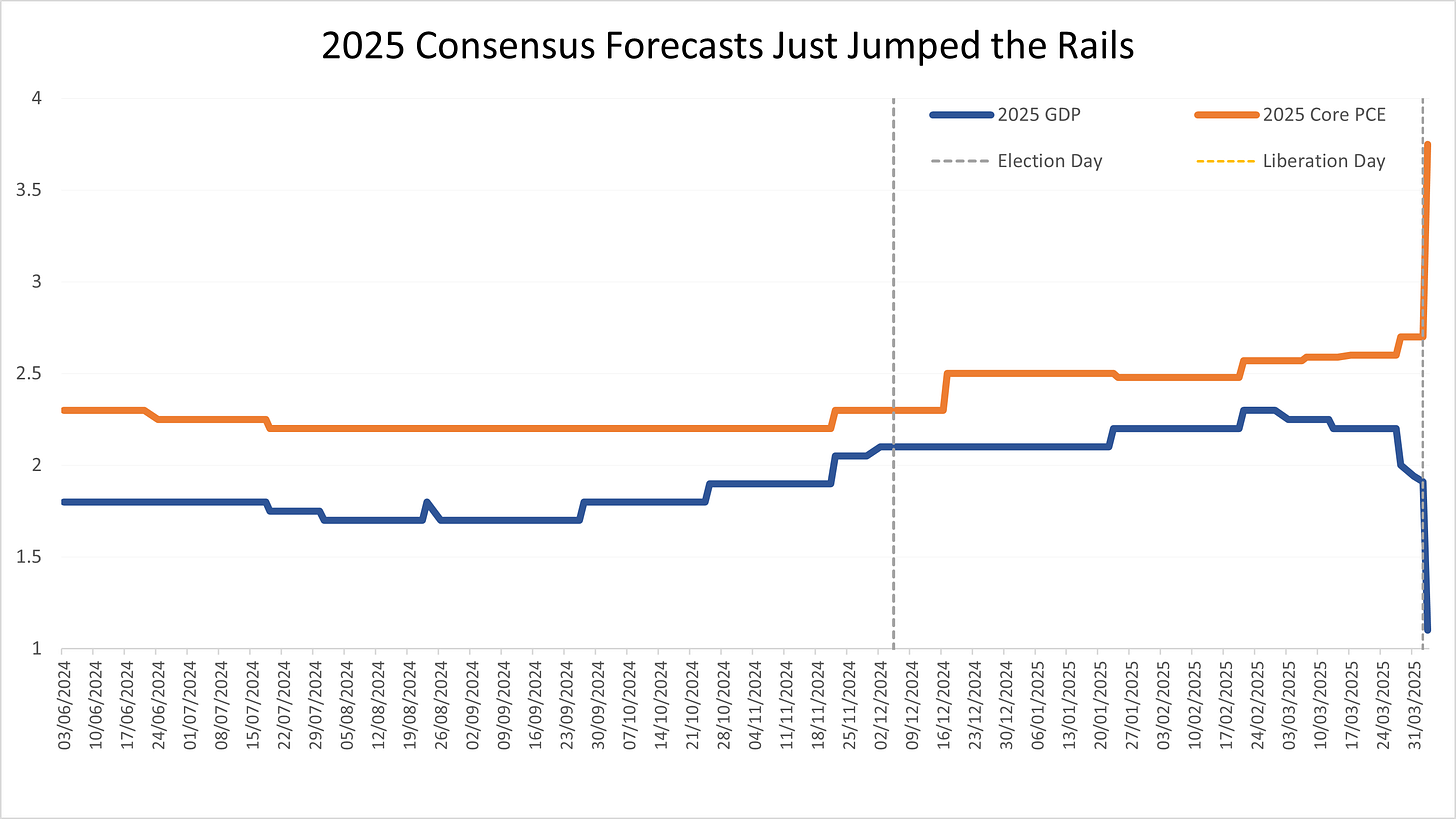

In response to the tariff announcements, the early US forecast revisions were to ratchet higher inflation and trample on growth. The childish delivery was almost guaranteed to deliver some retaliation. Proud nations can’t be seen to cower in front of a bully, and China, the world’s largest economy on PPP adjusted terms, was never likely to do so.

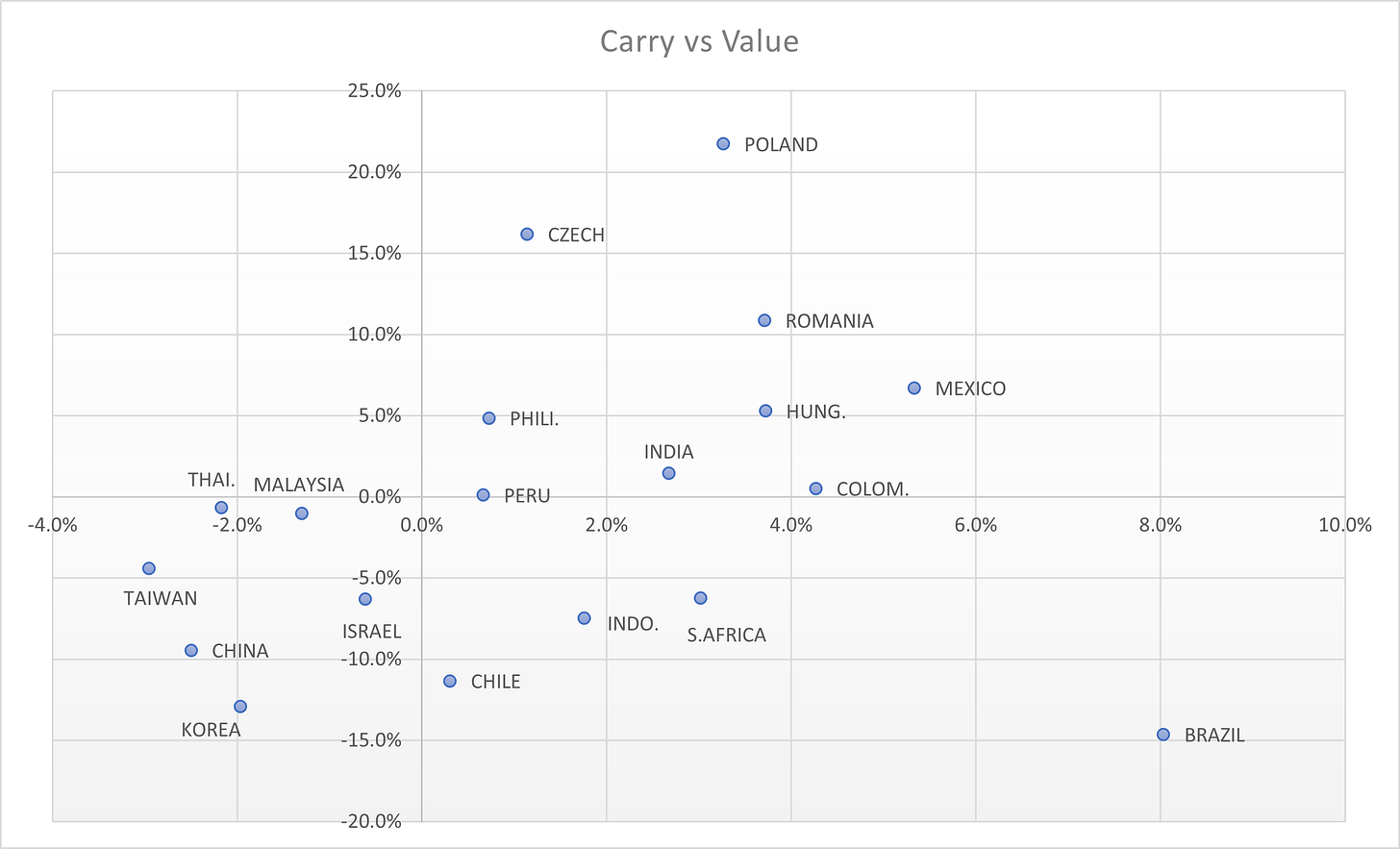

Before Trump blinked, we had gotten to the point where positions were thrown out regardless of merit, and high-yield EMFX was trading very much like a risk asset. As well it should. As discussed before, carry must be considered relative to vol, and when the vol gets this high, the carry can become deeply insufficient compensation for the risk.

By the end of the week, we had learned that there was indeed a Trump Put. The sharp sell-off in treasuries after days of equity losses seemed to be enough. Trump took the logical step of narrowing the focus of his tariffs. It never made sense to take on the world, and maybe this is the start of the process of making peace with former allies and narrowing the focus of policy. Reindustrialisation where it’s desirable, without trying to restore textiles or tariff penguins.

Regardless of how this plays out in the coming weeks, I think we can confidently say we’ve seen Paxxit. The slow, deliberate dismantling of the post-Cold War economic architecture that once anchored global confidence. The immediate macro implications may turn out to be only a small part of the story.

PAXXIT

What the US has just done - regardless of the size of the majority or the consensus among the population - is walk away from the political and economic architecture it built and led. With the painful parallels to Brexit - I think of this as Paxxit. The end of Pax-Americana.

The US no longer sees itself as the neutral steward of the system. The dollar, US capital markets, and the rule of law were all historically offered as public goods; now, they are being reframed as assets to be weaponised. If you’re a foreign central bank or multinational company, you’re watching this unfold and quietly reassessing your exposures.

The notion of rules is being replaced by grievance. Tariffs are no longer tactical, they’re pegged to bilateral trade deficits, regardless of the cause. That’s not policy; that’s emotional accounting. And the risks go beyond goods flows. Investment regimes, corporate access, and legal protections all start to wobble when reciprocity is defined by hurt feelings and fear rather than WTO schedules.

What will worry investors is that we’re on the road to eroding trust in the system. Institutions that used to act as anchors, such as the US Treasury, the Fed, and the courts, are no longer seen as sacred. This may not matter to most people today, but in a future crisis, it might. Will the Fed extend swap lines to EMs as quickly and freely as it has done in the past? Will US regulators still act in predictable, technocratic ways? Or will it all become part of the same transactional fog?

Markets can’t have fully priced this yet. Structural credibility isn’t something you mark to market until it’s gone. For now, risk premia remain mostly focused on recession risks. But the ice beneath global capital is thinner than it looks.

That’s Paxxit. A break not just from globalisation but from the US’ role as ballast in a storm. We may muddle through in the short term. But long term, this is the sort of shift that only becomes obvious in the rear-view mirror.

Sabotaging the USD

In early March, I wrote a note titled Sabotaging the US Dollar. At the time, the title felt provocative. It doesn’t anymore.

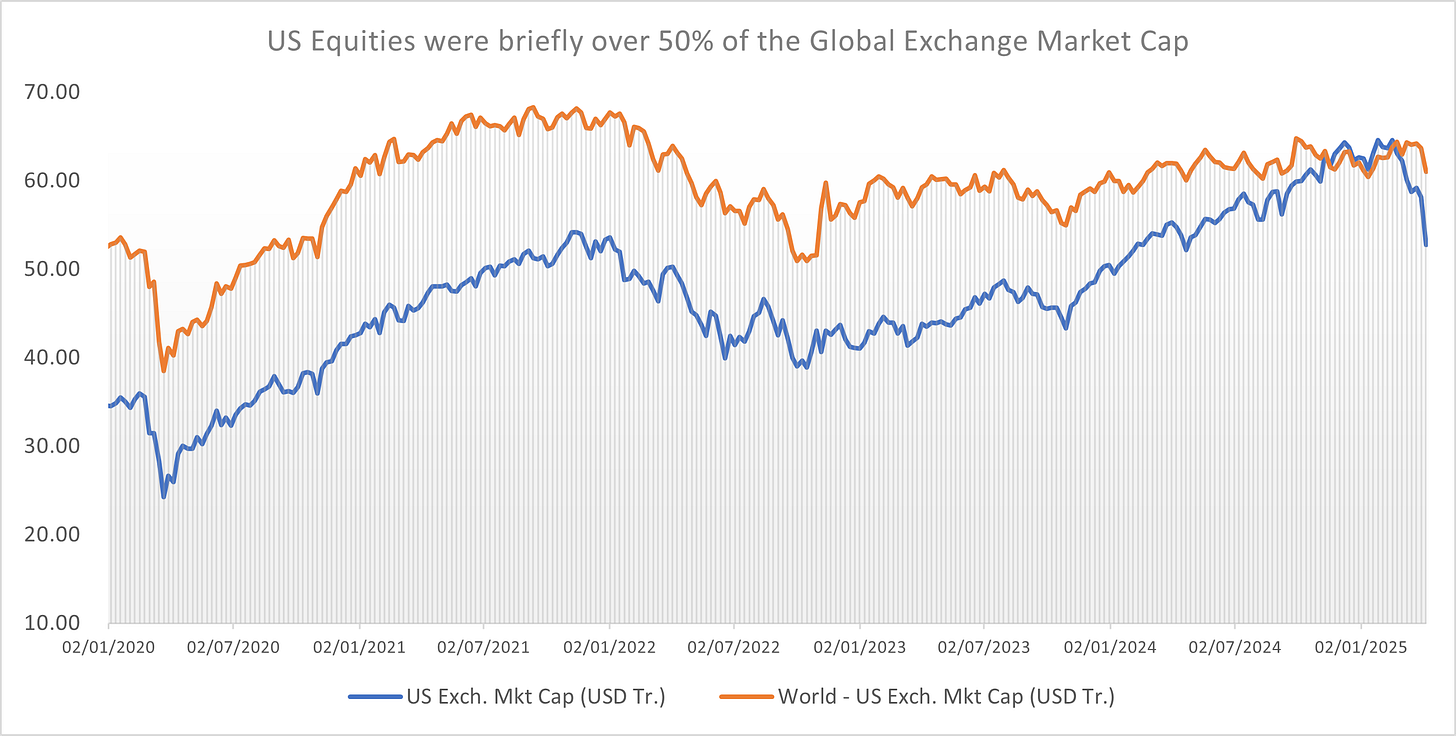

We’re now seeing the bear case for the USD come into focus. This is less about the trade balance, more about the erosion of what made the dollar exceptional. Deep markets, rule of law, a sense that capital parked in the US was capital that would be respected. The tone that Trump 2.0 has struck and the sloppily expressed views about allies from members of the regime (I’m looking at you JD) are hurting the brand. As I mentioned before, the S&P 500 Index derives a significant portion of its revenues from international markets. Most notably in its globally leading tech names, where some sources suggest close to 60% of revenues are derived from overseas consumers. Below, we see what might be the first step towards unwinding the dominant position US equities held in global markets.

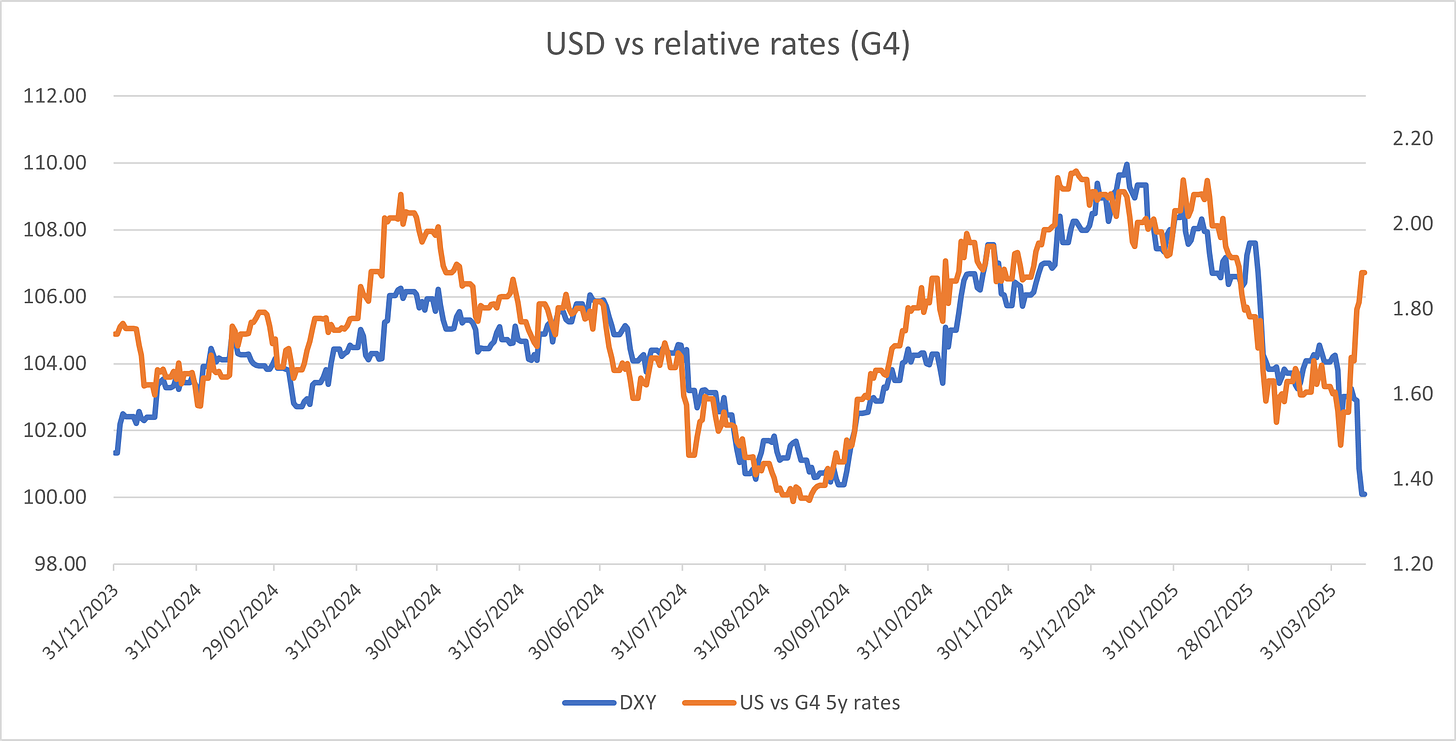

Up until last week, the weakness in the USD against the majors was based purely on the changes in macro expectations. US rates were high relative to other DMs, and thus, the global downturn had a relatively greater impact on the US curve, causing differentials to turn against the USD. That regime ended abruptly towards the end of last week when the relative rates and FX diverged sharply.

There are still no credible candidates to replace the USD as global reserve currency, but at the margin, there is a shift in preference, along with a strong suggestion that US assets are on the table as a weapon of the trade war.

EM FX: Carry, Chaos, and the Good Quadrant

I’ve been cautious towards EMFX vs the US since the election, with the policy mix containing damaging dynamics. The growth implications for China - while offset to an undetermined amount by stimulus - remain very negative. The outlook for USD funding is unclear as we wrestle downside growth risks with another round of inflationary shocks, coming at a time when we were struggling to polish off the last of the previous course.

Last week, we entered a regime where high yield EMFX traded as a risk asset, and all that mattered was the single factor (or the path of the rollercoaster). If the emergence of the Trump put stabilises markets and sees declining vols, then we may once more be in a position to pick winners. With the amount of disruption, it seems ever more prudent to avoid expensive currencies and to have a higher bar for carry trading.

I frequently refer to this chart comparing valuation and carry. The good quadrant is obvious: cheap currencies with carry. Chile is attractive but will be rewarded only if we see sufficient stimulus from China. South Africa has seen a reemergence of political risk, and we may see multiple cycles as the uneasy allies within the GNU fight to maintain credibility amongst their core supporters. Indonesia looks to have taken sufficient idiosynchratic pain in the near term, with a priority shift from the central bank hurting the IDR.

MXN, helped by softer tariffs, isn’t cheap enough to be really compelling, especially with such a weak cyclical position. Brazil still seems to offer sufficient risk premium to be a highly compelling long, despite the unresolved fiscal concerns. Although, one must be mindful that too deep a fall in Lula’s popularity could provoke a dangerous fiscal reaction. In Asia, Korea, on valuation grounds must be considered as a relative long.

Turkey: Still Carrying the Weight

March marked a significant turning point for Turkey. On March 19, Istanbul's Mayor, Ekrem İmamoğlu, a prominent opposition figure and potential presidential candidate, was arrested on charges of corruption and alleged ties to terrorist organisations. This move was widely perceived as politically motivated, aiming to sideline a key rival to President Recep Tayyip Erdoğan. The arrest ignited the largest anti-government protests Turkey had witnessed in over a decade. Hundreds of thousands took to the streets across major cities, expressing their dissent against what they viewed as an authoritarian crackdown on democratic institutions.

In line with stated priorities, the treasury and the central bank kept to their orthodox inflation-fighting priorities and absorbed capital outflows. With the TRY long the best FX sharp ratio trade of 2024, there were clearly some big leveraged positions, and the VaR shock that occurred necessitated a sizable unwind from offshore investors. Locals have so far been more sanguine (with their deposits), which makes sense to me. This bout of political risk comes with rates dramatically higher than in past episodes, and the central bank has successfully shown the cost of holding USD over a significant period. As long as local dollarisation remains muted, the TRY carry trade will continue to look compelling. The overwhelming base case is for another period of very high sharp ratio returns - albeit with higher political risks and elevated implied vols.

I joined a bank call with Simsek recently. While he didn’t comment on “ongoing judicial processes”, there was an undercurrent of realpolitik creeping in. He casually commented on how the global order was changing. Implying that Turkey is more important now in a multipolar world. He’s right, too. Hard power is back in fashion; Turkey knows it, and Erdogan will get more international leeway as a result.

Central Europe: Watching the Clock

Hungary remains problematic. The base case is a deterioration in fiscal dynamics as we head into elections next year. Orban has little interest in restraint and every incentive to juice the economy. The market has given him the benefit of the doubt before. I’m not sure it will again. The changing world order might offer Orban more scope for democratic backsliding, but the EU won’t. We could reach a critical point in that relationship, and the HUF will be a key release valve.

Poland has a different issue. Winning the presidency is key for the civic platform to push on and replace key offices and pursue past corruption cases. Polls point strongly towards this outcome, so a messy election represents a tail risk that international investors could be slow to wake up to. With PLN as expensive as it is, the risks seem asymmetric going into the vote.

China: The CNY Conundrum

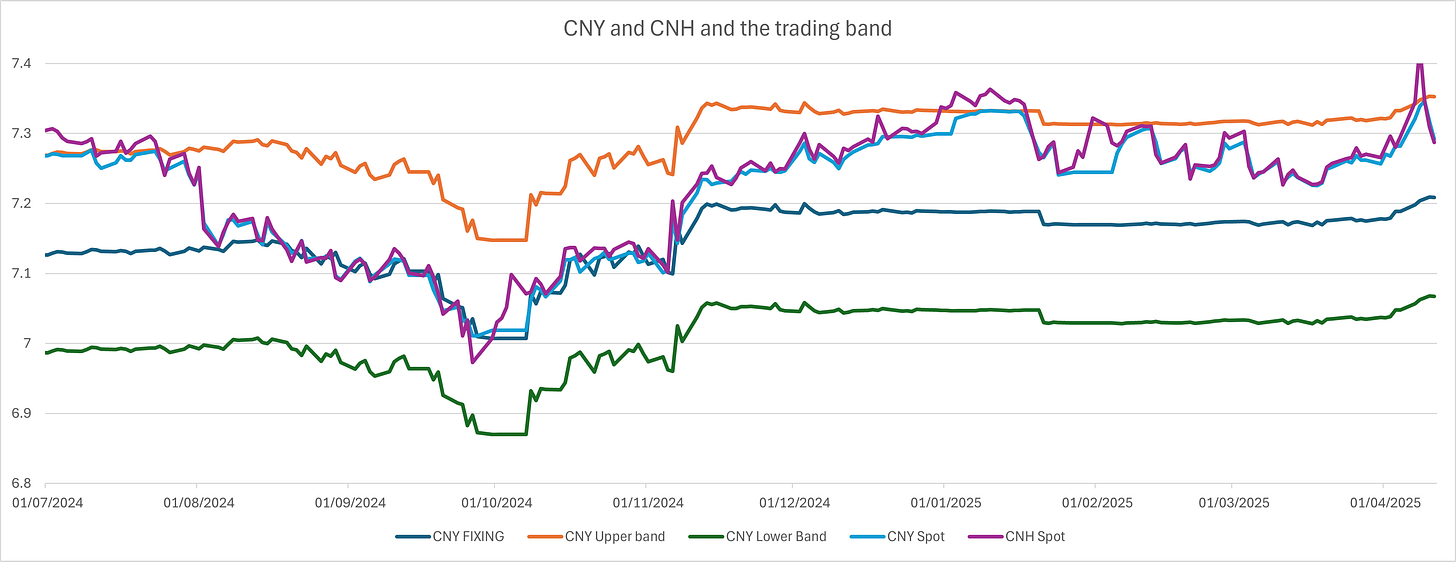

China has plenty of retaliatory tools. Tariffs were the obvious first step, but the currency remains a key tool. Traders have been washed around in the CNH trade this year, with heavy USD longs into the inauguration hurt, then USD shorts caught by the escallating tit for tat tariffs. On the case for stability in USDCNY, we know China values stability - especially in a crisis. They won’t want to invite capital flight. Also, broad USD weakening allows them to depreciate with a stable USDCNY.

So far, they have devalued the CNY subtly, allowing modest depreciation against the USD via the fix and more so against the basket. In some ways, the size of current tariffs is so large that any FX-based mitigation seems less pressing.

Brexit, Tribalism, and Harari - a final personal indulgence

Paxxit isn’t just a macro story. It’s a social and political one. And like most regime shifts, it rhymes.

As a Brit, I’ve seen this film before. Brexit was never really about trade. It was about belonging, identity, and the seduction of an imagined past. The slogan said “Take Back Control,” but the message was about grievance and exclusion. And when the policy costs began to bite - slower growth, weaker institutions, diminished global standing - people didn’t walk it back. They doubled down.

Not because the data supported them. Because tribal identity mattered more than policy outcomes.

I get the same sense with the current direction in the US. Tariffs are the surface layer. Beneath them lies something deeper: the instinct to view global interdependence not as strength but as betrayal. Economic self-harm isn’t seen as a mistake, but as sacrifice, an offering made on the altar of national identity. Many would clearly rather reshore than redistribute - even if it shrinks the overall pie.

Markets treat this as an error that can be corrected. But what if it isn’t? What if it’s the point?

This is where I find myself thinking of Yuval Noah Harari. I’ve long considered myself a disciple of his framing. His insight is that humanity’s strength lies in our ability to build shared myths. It’s those myths that allow cooperation at scale. But when the myth breaks down, what remains is power and tribe.

The liberal order that grew out of the postwar years had a myth: growth, peace, open markets, and rational governance. But the gains weren’t shared. The institutions grew aloof. And no new story came to replace the old one when it started to fail. The 2008 financial crisis showed the cracks in the system, and these were never closed.

Progressive politics tried to offer a new story, but it hasn’t stuck for much of the population. For some, it feels like a language they didn’t choose, a morality they didn’t vote for. The result has been a cultural backlash and a return to old anchors: religion, tradition, family, and nation. Not because they are working, but because they are familiar.

Without compelling new stories, the old, failed stories are being recycled. In the case of Trump’s America, it’s nationalism in a new package. Less Reagan, more grievance. Less aspiration, more control. The strongest voices on the other side risk recycling failed stories of socialism.

What concerns me isn’t the short-term hit to GDP. It’s the long-term corrosion of the architecture that made cooperation possible. And the vacuum where a better story ought to be. When I grew up, America was the shining city on the hill. A place of scale, innovation, and optimism. Its stories of freedom, ingenuity, and fairness shaped the world I expected to live in. At Disney, those stories are still going strong. My kids felt it. But they’re not enough on their own. Without leaders who believe in them and work to keep them alive, they start to feel like relics - comforting, familiar, but detached. At the Kennedy Space Center, you can see who’s filling the gap now. Bezos and Musk are the ones carrying the torch, not the state. And the space those old civic stories used to fill doesn’t stay empty for long.

Signing off…

Thank you for your time and attention. Please feel free to reach out with any feedback.

I will continue these notes ad hoc to keep in touch with a wider community of like-minded investors.

As always, if you’re trading, be disciplined and be lucky.

Stephen

Disclaimer

The contents of this note, including any analysis, opinions, and commentary, are purely for informational purposes and reflect solely the personal views of the author, Stephen Elgie, at the time of writing. They should not be construed as investment advice nor as an inducement, recommendation or solicitation to engage in any form of currency trading or other investment activities.

All information, data, and material presented in this note are believed to be accurate and reliable, yet they are not to be taken as a guarantee of future performance. The views expressed herein are subject to change without notice.

Readers are urged to exercise their own judgment and due diligence before making any investment decisions. The author and his employer, Argo Capital Management Limited accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material.

This note is not intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Nice article

Yep clear to see parallels with Brexit

Though that much less confrontational and had a narrower more achievable set of aims (independent migration and trade policy and break from fiscal union). Which ultimately I think was justified.

Paxxit as you put it has broad and potentially unacheivable aims.