12th Jan 2024

Personal Update

This is my first EMFX macro note for many months. In the second half of 2023, I joined Argo Capital Management, which is an EM-focused Hedge Fund. With their consent, I will write occasional personal views on the market. Argo invests in a range of EM assets from liquid macro-driven EM investments, such as those I discuss in these notes, to distressed debt. In past organisations, I’ve typically been the EM-focused member of a Macro business. Here at Argo, I’m on the more liquid-macro side of an EM business. I look forward to the experience.

This note contains:

Brief H2 2023 review

Early thoughts on 2024

Current trading views

Thoughts on Turkey

Updated monitors

Brief H2 2023 review

Given the time since my last note, I'll touch on the biggest moves from the intervening period. In my late summer notes, I talked about a more challenging H2 with the presence of easing EM central banks and a deteriorating growth outlook in China. As Q3 progressed, dynamics in US fixed income began to produce a considerable headwind for EM assets. Growing budget deficits, the absence of a clear end to the Fed tightening cycle, alongside a heavily inverted yield curve led to a sharp repricing of US term premium. Rapidly rising US 10-year yields came alongside a strengthening US dollar and provided a toxic mix for EM currencies. Signs that the US unemployment rate had troughed, along with some better news on US inflation towards the end of the year culminated in the Fed calling time on the hiking cycle at the December FOMC. EMFX recovered along with risk assets more broadly.

Above left you can see the selloff in 5y5y forward rates in the US alongside the move in the DXY. On the right, you can see the evolution of consensus forecasts for US inflation. There you can observe the increase in economists’ estimates for future quarters’ inflation rising in Q3 in the run-up to and during the term premium spike, then falling thereafter. Part of the reversal in expectations for inflation was due to the extent of rapid tightening of financial conditions, and a belief that these feed through quickly to the real economy.

Below is the performance of the trade-weighted index for each country in 2023 – data from the BIS.

In Asia, several central banks were forced into more hawkish policy stances due to rising US term premium, with some countries hiking to cover the risks of more pronounced depreciation pressures. One of these, Indonesia, was a popular destination for foreign bond flows and suffered more than most from the duration selloff as a result.

In CEEMEA, PLN began outperforming HUF once the Hungarian easing cycle began, with Poland getting a further boost from a market-friendly election outcome late in the year. Weak fundamentals continue to weigh on ZAR, but relative performance improved in H2. As other central banks began easing South Africa was forced to keep real rates higher, and this provided some level of support.

2023 was the year of LatAm currencies although by the end it was just COP, BRL, and MXN that delivered significant returns. The BRL NEER jumped in early December after a significant devaluation in Argentina. ARS still has a material (~8%) weighting in the broad BRL TWI. For our trading purposes, this is more of a distortion to discount.

Early thoughts on 2024

Starting a new year of trading is full of artificial constructs that are imposed by the calendar. One of which is the P&L clean slate, which is usually asymmetrically skewed towards a negative dynamic. If a prior year was positive, as 2023 was for many, then the cold reality of zero P&L cushion might be psychologically difficult. If last year was negative then the slate rarely feels truly clean, and drawdowns are often resilient to the calendar. Just as Christmas can cause an overindulgence in food and wine, there is also an excess of views and market commentary supplied in the run-up to the holidays, and this can lead to an anchoring of views that isn’t necessarily merited by the information set. Additionally, a consensus or trend can be allowed to overshoot into the end of a year when it has a performance cushion. This year, that consensus is the US Goldilocks narrative.

At the start of 2024, EMFX moves are still highly dependent on expectations of the Fed cycle, as you’ll see from my correlation monitor later. Many EM central banks have already begun their cutting cycles and some are well into the process. This EM easing eroded the available carry in H2 last year and in so doing exposed local currencies to some adverse moves. In turn, expectations of easing from the Fed widens the interest rate differential, helping support EM currencies. Should a significant Fed easing cycle emerge this should soften the USD and strengthen EMFX broadly. Local currency strength would feed through to both lower inflation pressures, and a greater capacity for a local central bank to ease. How each EM central bank chooses to react to any currency tailwind will have a bearing on relative currency performance. Where growth is weak, EMs will likely embrace the opportunity to lower rates more than the market currently anticipates. Many EM central banks are already explicitly rebuilding their FX reserves, and this is another key dynamic to watch in currency selection.

Much like last year, there are 2-sided risks to EMFX performance from evolving DM growth/inflation dynamics. Should growth disappoint significantly, recession risks will give a bid to the USD and we can expect weakness in EMFX, if only initially. Should headwinds emerge to the global disinflation process, then we can also expect turbulence in EMFX. This could be a similar process to Q3 2023, or something more enduring.

At this juncture, I feel a resurrection of fears over sticky inflation seems the more likely. This is particularly the case in the wake of the significant easing in US financial conditions we saw in late 2023. This easing should boost growth, temporarily diminishing the recessionary side of the risk distribution. Economists have frequently cautioned that the last phase of the disinflation process would be the hardest, and that’s something we’ll have to go through in 2024. To me, there is certainly scope for an uncomfortable extended bounce or plateauing in core inflation in the US, which could easily spook markets away from Goldilocks. Additionally, the potential for price-related spikes in headline inflation looks to be on the table for some time given the evolving geopolitical situation in the Middle East.

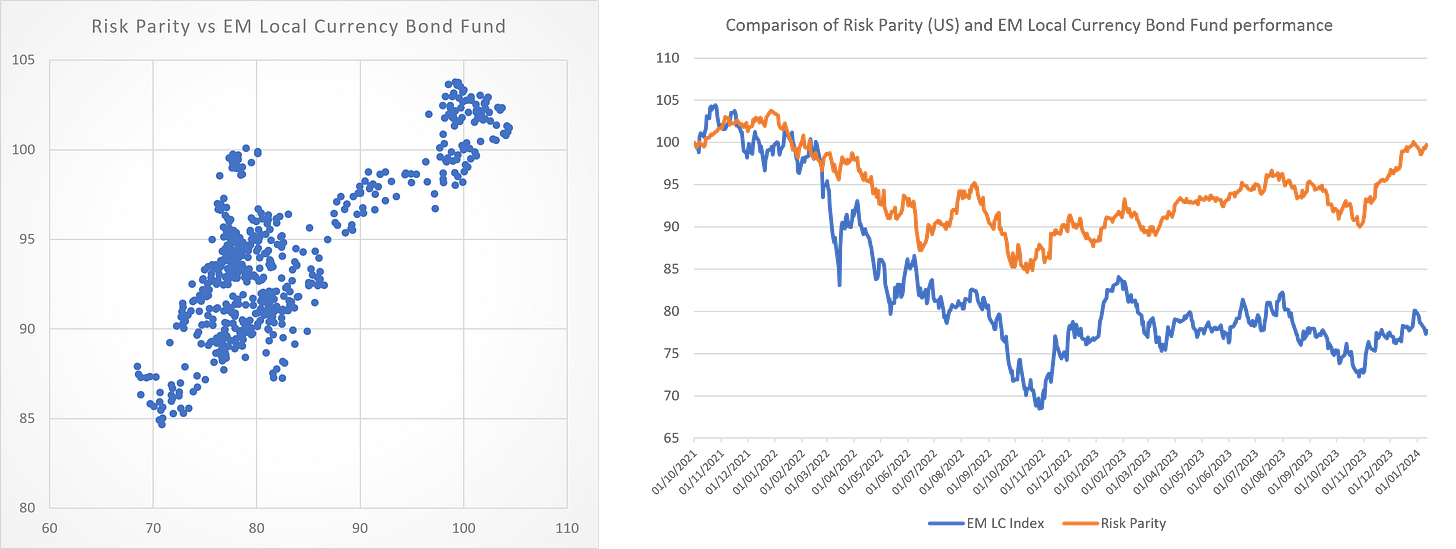

Whilst there’s scope for caution, the Goldilocks scenario is the base case, and with good entry points 2024 can be a profitable year for EMFX. In prior notes, I mentioned the relationship EMFX has with Risk Parity, as EM local currencies benefit from both risk appetite and demand for fixed income. The recent Fed Pivot would seem to raise the appeal of risk parity strategies, as a freshly pivoted Fed can be expected to react more responsively to negative growth shocks or sharp increases in financial conditions. The strike on the famous Fed put should be closer to the money – and this should be constructive for EMFX. I have been bullish on this dynamic since the start of last year, and personally long EM local bond funds, but these investments are yet to gain the level of broad subscription I had expected. Despite some encouraging performance, the flows into EM as an asset class have been tepid at best. Perhaps 2024 will see some more momentum build.

Current trading views

From a tactical perspective, I feel the current consensus may be oversubscribed compared with the information, and am cautious about owning too much risk accordingly. More compelling risk-reward opportunities than those that present today may be available soon, and I would rather be in a position to embrace them.

Medium term I still like the higher carry, higher ex-ante real rates currencies within EM. Screening for countries with better growth dynamics will be more important than earlier in the cycle. As inflation steps down, growth will play a larger role in driving FX (as described earlier).

Since returning to markets full-time, I’ve enjoyed working with the consensus forecast series available on Bloomberg. For FX I think the momentum of growth revisions and ex-ante real rates revisions provides a useful screen. Additionally, I like to look at the momentum in commodity terms of trade. Here is a flavour of the current state of play. I may go into greater depth on the use of these metrics in a future note.

From an ex-ante real rates perspective, levels matter and they continue to be a vital input to currency selection.

The above metrics and others lead me to favour Hungary within CEE, and Brazil and Colombia within LatAm. Asia looks like it’s mainly a destination to find shorts, with China, Taiwan, Malaysia and Thailand good candidates. India is the only currency in EM Asia that screens as a long.

I like the idea of beginning the year with some long EM risk against the EUR, to eliminate some of the big USD noise, pick up more carry, and also benefit from any pivot coming from the ECB. INR looks like a convenient vehicle, where I can see the appeal of the carry and the potential for bond inflows post index-inclusion. Reserve accumulation will continue to be a headwind to really exciting performance in that cross, but it looks attractive nonetheless.

At this stage of the recovery in EMFX, it’s worth having some eye now on value. In the case of MXN, I’d be inclined to be neutral or trade from the short side in light of the substantial real appreciation in recent years. BRL, by comparison, looks like a trade where it’s easier to see the potential upside.

In Asia, I remain structurally bearish on China. Last year I wrote several times on how I believe China’s growth model has hit the buffers and I don’t have much to add to that narrative. I still like being short CNH, both against high carry EM FX, but also against the JPY. Japanese policy is out of sync with most of the world, and there is scope for a correction lower in USDJPY over the course of the year. To avoid some of the negative carry, and to express my bearishness on China, I like being short the CNHJPY cross on a longer run horizon.

My preference remains trading carry in EMFX through RV trades (buying the high yielders vs the low yielders). In the same spirit, I now track the carry on the 3rd-5th highest yielders and 3rd-5th lowest yielders at any given point (from a set of 20 pairs).

As you can see the net carry declined from mid last year as policy easing began in EM. The absolute level, however, still looks elevated. This is mainly due to the depressed yields on many Asian currencies. As a result, I still like periodic exposure to EMFX relative carry.

Thoughts on Turkey

Back on the radar for EMFX traders – too soon to engage?

2024 is a year where many are already talking about the exceptional levels of carry available in TRY. Indeed, it screens even better when looking at Carry/Vol metrics. However, this is where the positive side of the story ends for me (for now). Real rates are still negative as are ex-ante real rates for 2024. The latter are so negative I have to exclude TRY from my chart.

Project credibility is going reasonably well in Turkey but scepticism remains over the long-term conviction to stick with the current level of orthodoxy. There are early signs of rebuilding net FX reserves, but they’re still negative on generally agreed-upon methods. Most importantly for the FX trade is that the currency is being guided weaker mainly in line with the forwards. This represents some real appreciation but the small gap between the forwards and an extrapolation of the current trend leaves only modest scope for pick up. There is some, but I would argue that it doesn’t currently compensate one for the asymmetric risk around the success or enduring nature of the current policy. There is both a risk that the current expected policy tightening won’t be sufficient and a risk that policymakers are once again leaned upon in a way that prevents the economy from receiving the medicine it requires. Nonetheless, TRY is back in play, and there may be opportunities to trade both sides as the story unfolds. The 12m Forwards look to offer a tradable combination of FX and rates, and I’ll be looking more closely at the edges of the range in the 12m FX Forward implied yields.

Monitors

These are similar to what I’ve presented in the past and for a similar function. For more explanation of their use - see earlier issues.

Correlation

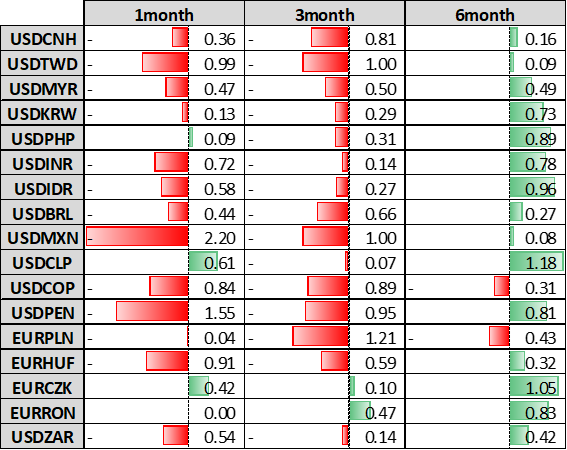

Looking at the evolution of EMFX correlations it looks like we are beginning to exit the most intense phase of a single driver trading environment. The US cycle will still be hugely influential, but there are signs that there is more scope for dispersion and idiosyncratic trades.

Trend

MXN, a popular long position of mine from H1 2023, has still been leading the pack in this recovery phase after the US term premium shocks of H2 last year.

Carry/Vol

LatAm and CEEMEA are still strong sources of carry with the basic structure unchanged from last year. There is probably scope to add a skew measure to this monitor and a smile component - so watch this space.

Signing off…

Thanks for your time and attention reading this update, please feel free to reach out with any feedback. As mentioned earlier, these notes will be infrequent but look forward to checking in periodically throughout the year.

As always, if you’re trading, be disciplined and be lucky.

Stephen

Disclaimer

The contents of this note, including any analysis, opinions, and commentary, are purely for informational purposes and reflect solely the personal views of the author, Stephen Elgie, at the time of writing. They should not be construed as investment advice nor as an inducement, recommendation or solicitation to engage in any form of currency trading or other investment activities.

All information, data, and material presented in this note are believed to be accurate and reliable, yet they are not to be taken as a guarantee of future performance. The views expressed herein are subject to change without notice.

Readers are urged to exercise their own judgment and due diligence before making any investment decisions. The author and his employer, Argo Capital Management Limited accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material.

This note is not intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Very good